France has a reputation to be a tax country and these taxes are particularly high. As a French person, I can say that it’s true and false (a typical French answer). In this article, we’ll focus on income tax, the main one you need to know about.

Also, don’t believe the rumors ! Taxes in France are not that high if you look at the global picture (almost no medical fees, subsidised energy cost, etc…

What is income tax ?

How is your income tax calculated?

The French income tax system is proportional and progressive. This means that the more you earn, the more you’ll pay taxes.

Let’s take some examples :

You’re a lucky single person (célibataire) who earns €75 000 (gross) a year. Your reference salary is €75 000 as you are alone in your household. You’ll then pay :

- €0 on the first €10 225 that you earn

- €1 742,95 on the next €15 845 because it’s €26 070 – €10 225 = €15 845 to which you apply the 11% rate.

- €14 542,5 on the next €48 475 because its €74 545 – €26 070 = €48 475 to which you apply the 30% rate

- €186,55 on the next €455 because it’s €75 000 – €74 545 = €455 to which you apply the 41% rate.

=> Your tax amount is €16 472

You’re a married couple with two kids that earn €75 000 (gross) a year. Your reference salary is €75 000/3 = €25 000 because the two parents account for 1 share each and every kid listed on the household accounts for 0,5 share. You’ll then pay :

- €0 on the first €10 225 that you earn

- €1 625,25 on the next €14 775 because it’s €25 000 – €10 225 = €14 775 to which you apply the 11% rate.

=> Your tax amount is €1 625,25 x 3 = 4 875,75

You’re a couple (either married or pacsed) who earn €75 000 (gross) a year. Your reference salary is €75 000/2 = €37 500 because there are two people in your household (non regarding the amount that any partner earns). You’ll then pay :

- €0 on the first €10 225 that you earn

- €1 742,95 on the next €15 845 because it’s €26 070 – €10 225 = €15 845 to which you apply the 11% rate.

- €3 429 on the next €11 430 because its €37 500 – €26 070 = €11 430 to which you apply the 30% rate

=> Your tax amount is €5 171,95 x 2 = 10 343,9

How to simulate your income tax in France?

Go to this website >> “Accéder au simulateur” >> “Modèle simplifié”

It’s free, State-managed and the fiscal administration doesn’t use the data you give in the simulation to draw up your actual tax sheet.

Step 1 : your personal status

Here you will be asked about :

- Your marital status (mandatory)

- Location of residency. Métropole means France in Europe, the others are French departments and regions overseas (mandatory)

- Date of birth (mandatory)

- Specific situations that can influence your taxable income (not mandatory)

- If you have children (not mandatory)

Step 2 : your income

Here you will be asked about :

- Your marital status (mandatory)

- Location of residency. Métropole means France in Europe, the others are French departments and regions overseas (mandatory)

- Date of birth (mandatory)

- Specific situations that can influence your taxable income (not mandatory)

- If you have children (not mandatory)

For most people, who only get an income as an employee, you’ll only have these boxes to fill.

- In the blue box: add your own gross income on the last year

- In the green box: add your partner’s income

- In the red boxes : add your kids’ income (if they have one), and if your kids still live with you (meaning they belong to your household).

Step 3 : your tax discounts

Here, you’ll let the fiscal administration know if you give to :

- Charities: fill up the 7UF box with the amount you gave over 1 year

- Political parties: fill up the 7UH box with the amount you gave over 1 year

These institutions will give you every year a “reçu fiscal” that recapitulates the amounts you gave, like the one you can see underneath.

Then just click on “Valider” in the bottom right-hand corner. The button is a bit hidden.

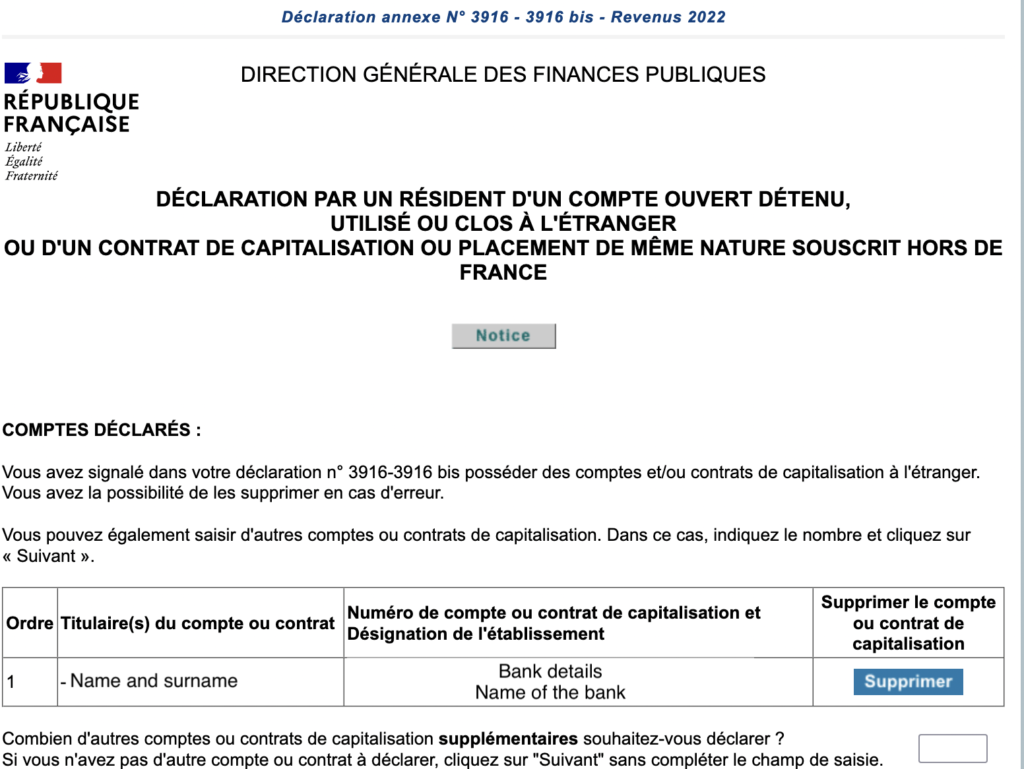

Step 4 : accounts held in other countries

During your simulation, you may be asked to declare that. However, it is mandatory when you declare your taxes, every year.

You need to declare them in a form called 3916 bis and it looks like this :

Does France tax foreign income?

The French tax system wasn’t complex enough on its own, we have to add the case when foreign income is involved and it gets tricky.

Basically, there are no rules. You may get taxed or not regarding a series of conditions :

- Does France have a tax agreement treaty with the country?

- What is the nature of the income (pension, wage…)?

- What is the amount of the income?

The basic principle is that France will avoid double taxation as much as possible, but you need to clarify your situation with the fiscal administration yourself.

Here you’ll find an article dedicated to foreing income taxation.

How to pay your income tax in France ?

What are the criteria to pay taxes in France – tax residency ?

We know that our readers may have a penthouse in Paris, a triplex in New York, and maybe a pied-à-terre in Tokyo, but there are very precise rules to determine where you’ll pay taxes.

You’ll pay your taxes in France if :

- Your permanent place of residence is in France

- Your source of income is located in France (whether it’s the company you work for or the place where you do business)

- You live in France for more than 6 months per year

Here are some other cases that might apply :

- You don’t tick any of these boxes, then your tax residency will be settled based on your nationality.

- You have dual nationality, then your tax residency will be the result of negotiations with the fiscal systems of your countries.

Direct debit

For most people in France, taxes are paid in direct debit. Every month, you’ll pay taxes based on your gross salary with a rate that has been determined according to the amount of taxes you paid the previous year.

Also, for specific situations such as liberals professions or craftsmen, different measures may apply.

Deadline

Even though you’re debited every month, once a year, around April to June, the fiscal administration requires you to validate your tax return either on paper or on a specific website in order to make sure that your rate is still in accordance with your earnings.

How do I get a “numéro fiscal” to pay taxes?

In France, in order to pay taxes, you need a “numéro fiscal”. It is a personal 13-digit number that the taxes administration uses to categorize every tax-paying resident in France.

Step 2

Then, click on “Vous n’avez pas encore de numéro fiscal” and click on the link that will appear when you unfold the tab.

Step 3

A new page will open, you’ll have to fill it like shown underneath and, then, click on the box “Je n’ai pas de numéro fiscal” on the last row.

Then the page will unfold, revealing this paragraph. Just click on the second link.

Step 4

Fill in the form and send it. After that, you’ll have to wait a bit for fiscal administration to process your request and get your “numéro fiscal”.

Tips and tricks

- Check the tax system in your own country, you may need to declare your income over there

- Don’t forget to adjust your rate every time your work status change, if you get a raise or change jobs. Otherwise, you may have a load to pay. For example, I got a raise in 2020 and forgot to adjust my rate, I had to pay over 2k of back taxes. Juliette got the same thing but with a sum along the lines of 5k.