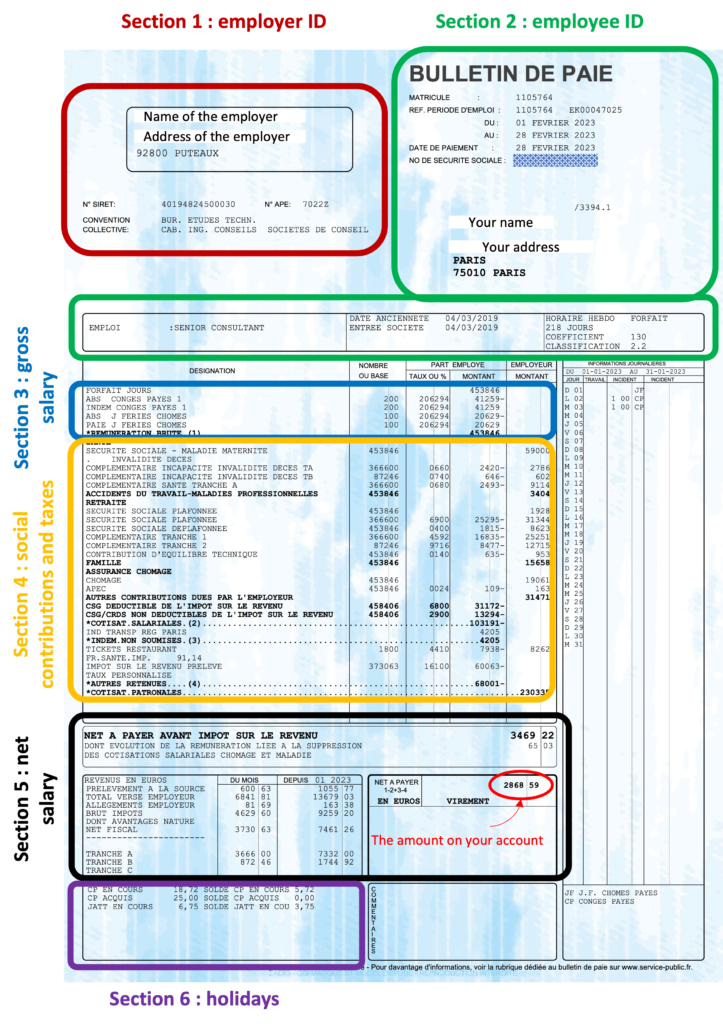

Every month, you get a piece of paper and you never know what the figures mean ? Here is the answer to your questions about reading your payslip.

Section 1 : employer ID

What is it?

This section recaps the information about your employer. Here is what you’ll find :

- Name and address of the company

- N° SIRET & APE : these are legal registration numbers for French companies

- Convention Collective : in France, every company belongs to a syndicate of companies of the same kind of activities (not a union). This syndicate can set some rules about work hours, pay, holidays … different to the main work law of France. A basic principle is that if you’re different from the common rule, it must be more favourable to the employees.

Is this section of the payslip important?

Not really if everything is fine with your company.

It can become interesting if you start having trouble with your company because the convention collective’s website can give you some context about why some rules apply to you.

Note : this section is mandatory on every pay payslip in France. If it’s not mentioned, you can ask your employer to rectify the situation.

Section 2 : Employee ID

What is it?

These are all the information pertinent to you. You’ll find there :

- your name and address ;

- Social security number

- Type of job (Emploi)

- Status in the company (coefficient / classification)

Is this section of the payslip important?

Yes, it is important for two reasons :

- If there is a mistake regarding your personal information, your salary may not reach your bank account. Make sure you alert your company to modify anything that’s wrong.

- Your salary, bonuses etc are set based on guidelines defined in the Convention Collective. Based on your coefficient and classification there are upper and lower limits to your remuneration. If you have time, it’s always interesting to have a look at the website of the Convention Collective and make sure your salary is within these boundaries.

Section 3 : gross salary

What is it?

This figure is what the company pays when it transfers your salary. In France, you have to deduct around 25% of that gross salary to get your net salary amount.

This also includes if you took days off, and how many.

Is this section of the payslip important?

Yep, this shows exactly what you’ll be paid.

Section 4 : Social contributions and taxes

What is it?

Ok, let’s take a deep breath, because this is where it gets technical and physical. This whole yellow section recaps all the taxes and social contributions applied to your salary. It would be simple to apply a rate, like 20% on to your gross salary and say that’s what the state takes to finance social security – but we’re in France, that would be too simple (wink wink).

Here is the method to decipher this list of figures, from left to right :

- The first column is the destination of the money (for retirement, for unemployment…)

- The second column gives you the basis on which the rate will be applied. As an example : Securité social – maladie maternité applies on the whole gross salary BUT the complémentaire santé tranche A only applies on a fraction of your gross salary.

- The third column gives you the applied rate : on this payslip the applied rate is 6.8% on CSG déductible de l’impôt sur le revenu.

- The fourth column is the amount of the tax withheld on your gross salary

- The fifth column is a matching amount of what the employers pay (quick note : your gross salary is not everything that the employers pay, there is a gross gross salary that includes employer taxes).

Finally, you can find there some lines about :

- Reimbursement of transport fees (IND TRANSP REG PARIS)

- Restaurant tickets (you get this if your company does not offer a subsidised cantine)

- Income tax (In France, it’s deducted at the source and you can see there how much you paid and the applied rate / you can modify this applied rate on impots.gouv.fr)

Is this section of the payslip important?

Not for all the taxes and social contributions, but yes when we get to the income tax.

Section 5 : Net salary

What is it?

When you’ve removed all the taxes and contributions from your gross salary, you get a net salary. That’s the big figure (€3469.22). But that’s not what you get on your account, because you have to apply the income tax to this net salary to get your net net salary (the figure circled in red).

Is this section of the payslip important?

Yes, it is the whole purpose of the payslip! It also recaps how much you’ve paid in taxes and some other info that could be useful to get loans etc as some banks require you to give your “net fiscal” which is greater than your net salary.

Section 6 : Holidays

What is it?

Last off, the holidays. You know these are sacred in France. Here is what this section means:

- CP EN COURS : the amount of days of “congés payés” that the employee will get over the year (from June 1st to May 31st).

- CP ACQUIS : the amount of days of “congés payés” that the employee received over the last periode (from June 1st to May 31st n-1).

- SOLDE CP EN COURS : the number of days of “congés payés” that you acquire over the year that remains for you to use until May 31st.

- SOLDE CP ACQUIS : the number of days of “congés payés” that you acquired over the last period (year N-1) that remains for you to use until May 31st.

Note : JATT is a kind of congé payé.

Is this section of the payslip important?

Of course, there you have all information about the days off you have left and how many you will accumulate over the year.